Fulfill Your Dreams With Shriram Unnati Fixed Deposit Scheme

“FAAA / Stable” by CRISIL (indicates the highest degree of safety) Safe, Secure and enjoy high returns

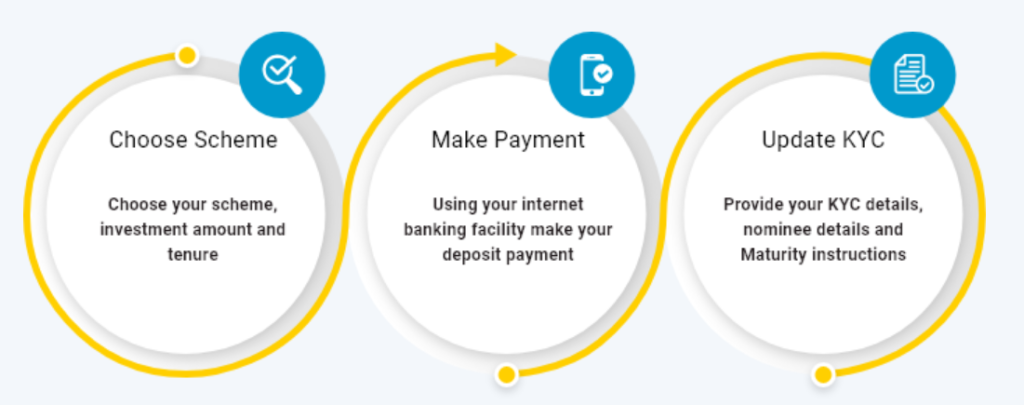

How to Open Shriram Fixed Deposit Online Account

Fixed Deposit Certificate will be sent to your registered email address.

Shriram Fixed Deposit Product Features

More Return On FD

Shriram Transport Finance Company offers the highest interest rates for term deposits. You can get interest rate up to 7.75%. Senior citizens can get an additional refund of 0.30% and above the normal interest rate. You can get effective income up to 9.05%

Power Of Compunding

With cumulative term deposits, you can get a maximum return of 9.05% with the help of compounding at the end of maturity. You will earn interest on the amount invested and the interest you receive.

Consistent Income

With a non-cumulative fixed deposit, you can get interest rates with money deposited over a fixed period of time. By choosing a monthly, quarterly, half-yearly or annual interest payment, you get regular earnings through interest payments.

Immediate Liquidity

In term deposits, you will enjoy liquidity in case of emergency, as you can close the deposit to support your need. You can also borrow on your deposit.

High Flexibity

There is a wide range of flexible periods ranging from 12 months to 60 months for efficient planning of short-term and long-term financial objectives.

Assured Returns

In the era of falling interest rates, Fixed deposits offer assured and stable returns.

Why Shriram Transport Fin.Co.?

- STFC is the largest and most trusted asset based NBFC in India.

- Attractive return on investment with maximum security.

- With wide availability of 1758 branches and 831 rural centers decentralized across the country for personal services. STFC 27218 is working with dedicated staff.

- Shriram Transport Finance Company has the highest rating of "MAA + / Stable Outlook" by ICRA, Stable by FAAA / CRISIL (indicates high credit quality)

- Proven track record of payment of term deposits for over 40 years and on track.

Shriram FD Interest Rates 2021

|

Non Cumulative Deposit

|

Cumulative Deposit

|

|||||

|---|---|---|---|---|---|---|

|

Period (months)

|

Monthly % p.a

|

Quarterly % p.a

|

Half yearly % p.a

|

Yearly % p.a

|

Effective yield % p.a

|

Maturity value for Rs 5,000/-

|

|

12

|

7.25

|

2

|

2

|

2

|

2

|

2

|

|

24

|

3

|

3

|

3

|

3

|

3

|

3

|

|

36

|

4

|

4

|

4

|

4

|

4

|

4

|

|

48

|

5

|

5

|

5

|

5

|

5

|

5

|

- Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer et est dolor. Donec maximus id enim eu mollis.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer et est dolor. Donec maximus id enim eu mollis.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer et est dolor. Donec maximus id enim eu mollis.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer et est dolor. Donec maximus id enim eu mollis.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer et est dolor. Donec maximus id enim eu mollis.

Benefits of opening a fixed deposit online

Convenience

You can invest in term deposits online anywhere in a few minutes, anywhere, anytime at your convenience.

Ease

You can move funds from your bank account and book your term deposit easily.

Flexibility

Enjoy flexibility in choosing the investment amount and duration of your fixed deposit according to your financial objectives.

Cumulative

In a cumulative term deposit plan, you will not receive fixed interest payable on a monthly, quarterly, half-yearly or annual basis. The interest rate is compounded with the principal and is payable at maturity.

Non-Comulative

In a non-cumulative fixed deposit scheme, interest is payable on a monthly, quarterly, half-yearly or annual basis. The interest received monthly under this scheme will be taxable. This plan is most suitable for a person who needs to pay interest from time to time.

What Do Our Customers Have to Say?

Frequently Asked Questions

Cumulative and Non Cumulative schemes are available.